Rent Repayment Order case on appeal - how will it impact letting agents?

Rent Repayment Orders could soon have greater consequences for letting agents as a long-running dispute over to whom they apply will be heard by the Supreme Court. Given the surge of rent-to-rent landlords in recent years, its outcome will place ever-greater pressure on those involved in property rental to know the ins and outs of property law. Here's what you need to know.

What is a Rent Repayment Order?

A Rent Repayment Order (or RRO) is an order which demands a landlord to repay up to a year’s rent, housing benefit or the housing costs’ portion of Universal Credit paid by a tenant or council in a situation when the landlord has committed one of the following offences:

- Using or threatening violence to enter a home

- Illegal eviction or harassment

- Failing to comply with an improvement notice

- Failing to comply with a prohibition order

- Breaking a banning order

- Letting an unlicensed home in an additional or selective licensed area

- Letting an unlicensed house in multiple occupation (HMO)

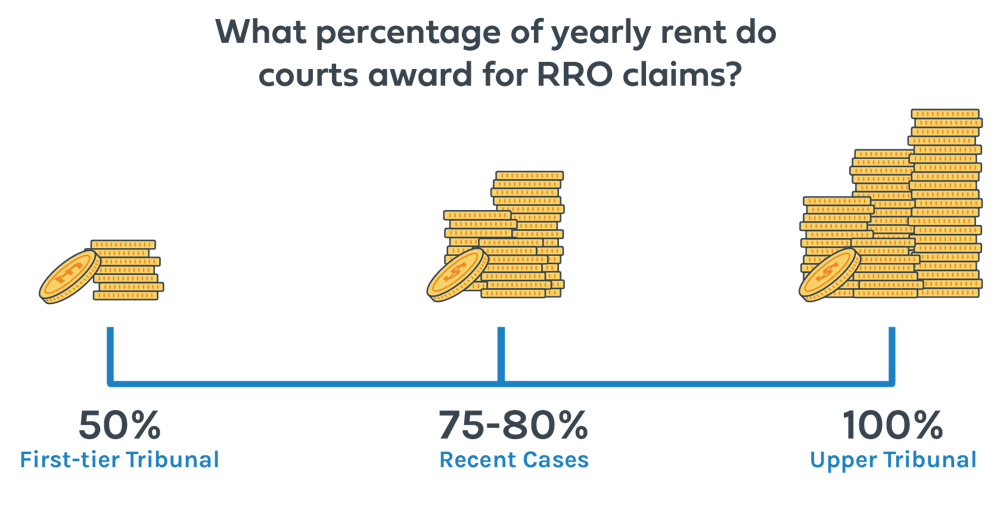

The RRO claim must be made within 12 months of the application date and can involve up to 12 months’ rent being reclaimed. The amount occupiers can receive has fluctuated over time according to court decisions. At one point, the position of the Upper Tribunal was that occupiers were by default entitled to all 12 months of their rent, or 100%. Prior to this, the First-tier Tribunal leaned towards 50%. More recent cases have awarded between 75 and 80%.

Who does an RRO apply to?

To who the RRO applies is the main question brought to the fore by Rakusen vs Jepsen & Ors, which focuses on whether the landlord liable to pay the RRO is the immediate landlord or the superior landlord.

While having more than one landlord might sound like a unique situation, it’s actually more common than you’d think. Sometimes, although an individual or company owns the building, the right to collect the rent for it may lie with a company, or this right might be sold on by rent-to-rent operators. In a few cases, rogue landlords sign off with false names to avoid RROs.

In the case of Rakusen vs Jepsen, the tenants paid their rent to an investment group (the immediate landlord), who then passed it onto the property’s owner (the superior landlord). When the property was found to be incorrectly licensed, the tenants sought an RRO. This was where the issues about who was liable to pay it began.

What happened in the Rakusen vs Jepsen case?

Rakusen, the superior landlord, granted the tenancy of his London flat to a property investment group, Kensington Property Investment Group Ltd (KPIG), in May 2016, to who he’d been introduced by sales and letting agents, Hamptons. KPIG then entered into written agreements with 4 separate tenants, making the property an HMO, meaning it required a licence. In November 2018, Hamptons told Rakusen that KPIG wanted to apply for an HMO licence, but none was granted, and Rakusen did not renew KPIG’s tenancy in May 2019.

First-tier Tribunal ruling

On the grounds that the property had not been licensed correctly, the tenants, Jepsen and others, applied for an RRO against Rakusen. The case was heard before the First-tier Tribunal on 18 December 2019, which granted the Order against Rakusen, totalling £26,140.

Upper Tribunal decision

Rakusen appealed, and the case was heard in the Upper Tribunal on 11 November 2020. The Upper Tribunal disagreed with the First-tier Tribunal and held that the law applied to both immediate and superior landlords.

Court of Appeal

The case then went to the Court of Appeal. On 29 July 2021, it overturned the earlier judgement and ruled that the RRO could apply only to an immediate landlord rather than the superior landlord. This outcome was good news for landlords who find their tenants have entered into sub-lets without consultation, but it makes things difficult for those trying to hold evasive landlords in rent-to-rent scams accountable.

The final stage - the Supreme Court

Subsequently, the Rakusen vs Jepsen tenants appealed against the ruling, and the case will now be heard at the Supreme Court. The Supreme Court ruling, which is likely to come in late 2022 or early 2023, will be the final ruling and will have huge implications for the sector. Depending on the ruling, letting agents may now find themselves in the firing line, with RROs potentially being levelled at anyone managing a property on behalf of a superior landlord.

How does this affect agents?

The Housing Act 2004 places responsibility for licensing a property on anyone who meets the statutory definition of a person ‘having control’ of or ‘managing’ a property. This includes arranging a tenancy, even if the agent is not responsible for collecting rents. The days of letting agents taking the view that licensing a property is something for landlords to worry about are long gone. Now, all agents need to have systems in place to ensure that a suitable license is granted whenever they arrange a tenancy, regardless if it was based on a let-only agreement, with no rent collection or management duties.

The increasingly broad definition given to ‘person managing’ the property by the courts means that blaming the landlord is not going to be an adequate defence. Given the turn the Rakusen vs Jepsen case is taking, agents who don’t do their due diligence could find themselves liable to expensive Rent Repayment Orders or expose their landlords to similar penalties. The impact that this could have reputationally for an agent cannot be overstated.

How can agents manage this issue?

Agents need to thoroughly vet the properties they take on and ensure they know exactly what legal or mandatory requirements apply to them. They should also have a comprehensive knowledge of the area where their properties are located so that they are aware of whether or not selective licensing applies.

When it comes to maintaining licenses and ensuring your portfolio is up to date with other compliance issues, it’s worth utilising the possibilities of technology. Fixflo allows agents to schedule property license renewal as a recurring event using its planned maintenance feature, which is one easy way to make sure that you don’t forget and risk receiving fines or a Rent Repayment Order.

This is just one of dozens of things its planned maintenance can take care of. Everything from checking on contractor qualifications to issuing invoices can be scheduled and automated. Delegation of these types of tasks frees up agent time to dedicate to providing higher levels of service and building landlord relationships.

Whatever the outcome of the case, Rakusen vs Jepsen reminds us how important it is for agents to ensure all the properties in their portfolio are correctly licensed because failure to do so remains a serious breach of trust between landlord, agent and occupier.

Find out more about the ins and outs of property licensing, including exactly what is needed and how the application process works, in our Quick Guide to Property and HMO Licensing in England and Wales.

BLOG DISCLAIMER

This article is intended for information purposes only and does not constitute legal advice. If you have any questions related to issues in this article, we strongly advise contacting a legal professional.

These blog posts are the work of Fixflo and are licensed under a Creative Commons Attribution-ShareAlike 3.0 Unported License. In summary, you are welcome to re-publish any of these blog posts but are asked to attribute Fixflo with an appropriate link to www.fixflo.com. Access to this blog is allowed only subject to the acceptance of these terms.