Water escape is what it sounds like: water escaping from the mains supply. This is usually covered by buildings insurance and contents insurance.

Buildings insurance premiums are on an upward trajectory, and while fire risk is often the first culprit that comes to mind, in fact, the most frequent threat is escaped water.

A seemingly innocuous leak, drip, or burst pipe can lead to extensive and costly repairs, making it paramount for block managers to understand why water escape is driving insurance rates up and the steps they need to take to protect their assets.

The water could escape from a:

- water pipe

- domestic appliance

- fixed central heating system

- fixed water tank

- pipes above ground

- faulty grout or sealant

Burst pipes are the most common cause of water escape, usually in freezing weather.

The ones covered by insurance are:

- water pipe

- domestic appliance

- fixed central heating system

- fixed water tank

However, while most insurance products will cover these, not all will. It is worth checking in each individual case.

Steps to take when water escape occurs in a block

Immediate action

The first step is to stop the leak. Once alerted to the issue, turn off the main water supply to prevent further damage. If the specific source of the leak is identified, the relevant valve could be disabled instead, which would still stop the flow of water and prevent additional damage.

Once the water has been stopped, take measures to protect belongings from further harm. Move any furniture or possessions out of the affected area if possible. For items that can't be moved, cover them with plastic sheeting, tarps, or any other waterproof material available. This will help to minimise water damage.

Other actions include draining the system by running the cold tap, turning off the power and avoiding all electrical appliances, plus opening doors and windows.

If the leak has the potential to affect neighbouring properties, it's important to inform them of the situation as soon as possible. This will give them the opportunity to take any necessary precautions to protect their own homes from water damage.

Investigate the source

Identify the source. Determine if the leak originated from an internal plumbing issue, an appliance, or a communal pipe. Once this is found, the cause should also be identified. A property agent needs to understand why the leak occurred, such as whether it was due to a burst pipe, faulty appliance, or other factors.

The damage needs to be documented in all cases. Taking photos and videos of the affected areas is vital to document the extent of the damage.

Carry out repairs

Ensure that repairs are carried out correctly and effectively so that the leak is fully resolved. The block manager should advise the occupant to check for signs of the leak returning once the repairs have been completed.

How to protect blocks from water escape

Preventative maintenance

Regularly inspect and maintain plumbing systems to reduce the risk of leaks. This includes checking for signs of wear and tear, such as corrosion or cracks, and ensuring that all pipes and fittings are properly sealed. It may be beneficial to schedule annual inspections by a qualified plumber to identify and address any potential issues before they escalate into major leaks.

It's worth creating an advance plan for responding to water leaks. This plan should include a list of emergency contacts, such as plumbers and water damage restoration companies, as well as detailed steps to take in the event of a leak. These steps may include shutting off the main water supply, evacuating residents if necessary, and contacting insurance providers.

Training

Block managers and building staff play a crucial role in maintaining a building's integrity and ensuring the safety of its occupants. Part of this responsibility involves being able to identify signs of water escape, which can lead to costly damage and disruptions if not addressed promptly. Therefore, staff should be trained to know the signs.

Insurance

Ensure that the building's insurance policy adequately covers the risk of water leaks.

Ensure that the building's insurance policy includes comprehensive coverage for water damage, specifically addressing leaks and escape of water from any source within the building.

Review the policy's sum insured to ensure it is sufficient to cover the potential costs of water damage, including repairs, restoration, and temporary accommodation if necessary. Our Reinstatement Cost Assessments explainer guide details exactly how this works.

Be aware of the policy's excess or deductible, which is the amount you will need to pay out of pocket before the insurance coverage kicks in.

Review the insurance policy regularly to ensure it continues to meet the building's needs and remains compliant with any changes in regulations or building codes.

Documentation

Meticulously document all aspects of the water escape, starting with the precise location where the leak originated. Note the date and time the leak was first discovered, and include a detailed description of the water's source, such as a burst pipe, overflowing toilet, or roof leak. Take photographs or videos of the damage, if possible.

Keep a chronological log of all actions taken to mitigate the leak and subsequent damage. This includes contacting plumbers, water damage restoration companies, or insurance providers. Document all conversations, including dates, times, and names of individuals spoken to. Retain all invoices, receipts, and estimates related to the repair work.

This comprehensive documentation will be invaluable for insurance claims and potential legal disputes, and as a reference for future maintenance and prevention efforts.

Claims

Occasionally, insurers will class certain water claims as accidental damage claims. The reason that they do this is because all insurers that are regulated by the Financial Conduct Authority (FCA) have a responsibility to effectively even out the claims that they're experiencing. If they've had a particularly bad year on water claims, towards the end of their year they may start to do this.

Courtesy of Insurety

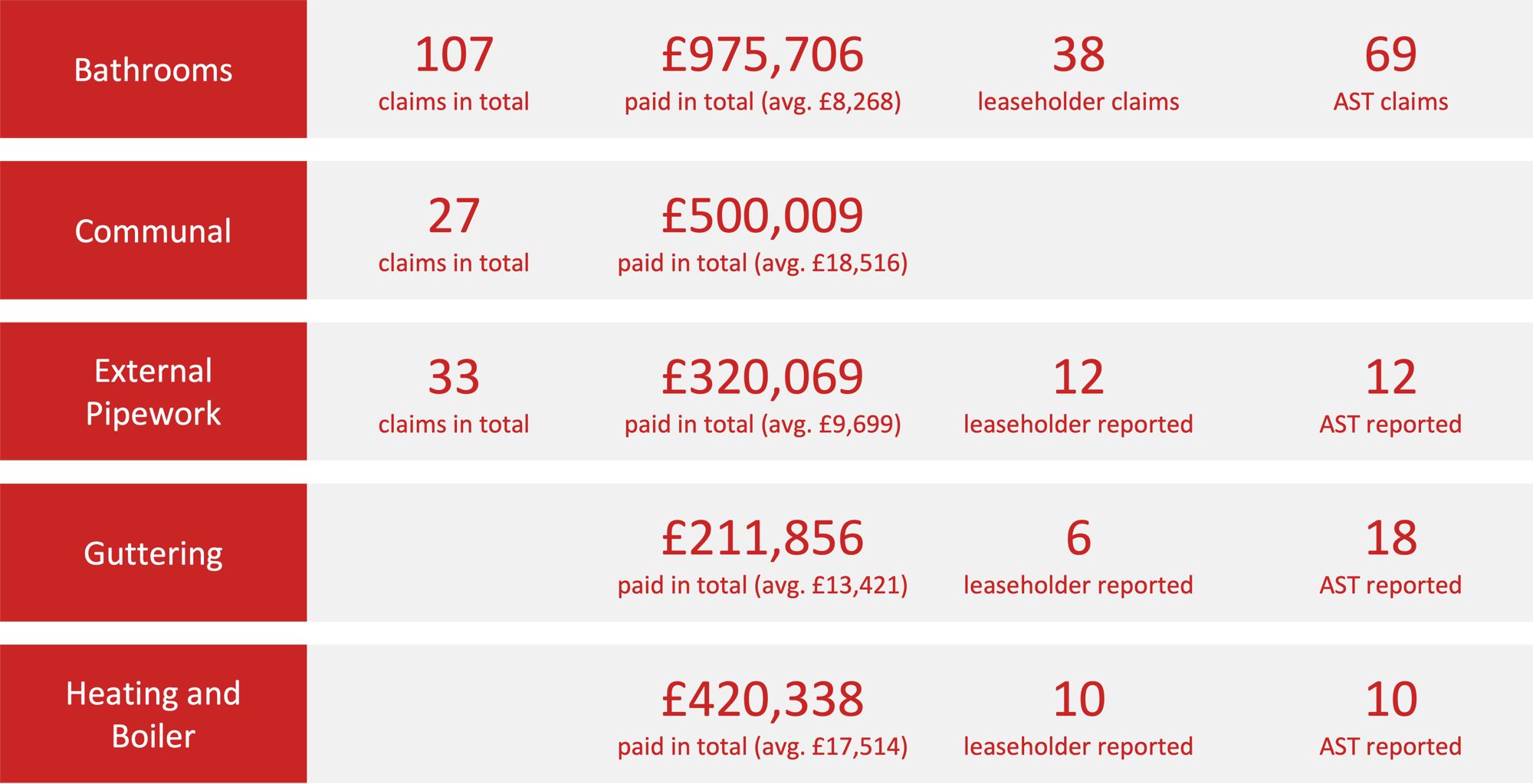

Insurety, a specialist agency in property insurance, has seen over £5.2 million of escaped water claims in the past five years. During the same period, the premium collective was around £25 million, which refers to a scenario where the escape of water results in damage to multiple properties or is a large, costly event, potentially triggering a higher insurance premium for the affected parties. This means water escape claims make up around a fifth of the premium Insurety is collecting. The average claim amount continues to increase year on year, and as of 2025, it is around £13,000 per claim. This figure was about £2,000 only 20 years ago.

Brexit impacted this, with a lack of skilled trade in the market now. Also, building material costs have skyrocketed.

Courtesy of Insurety

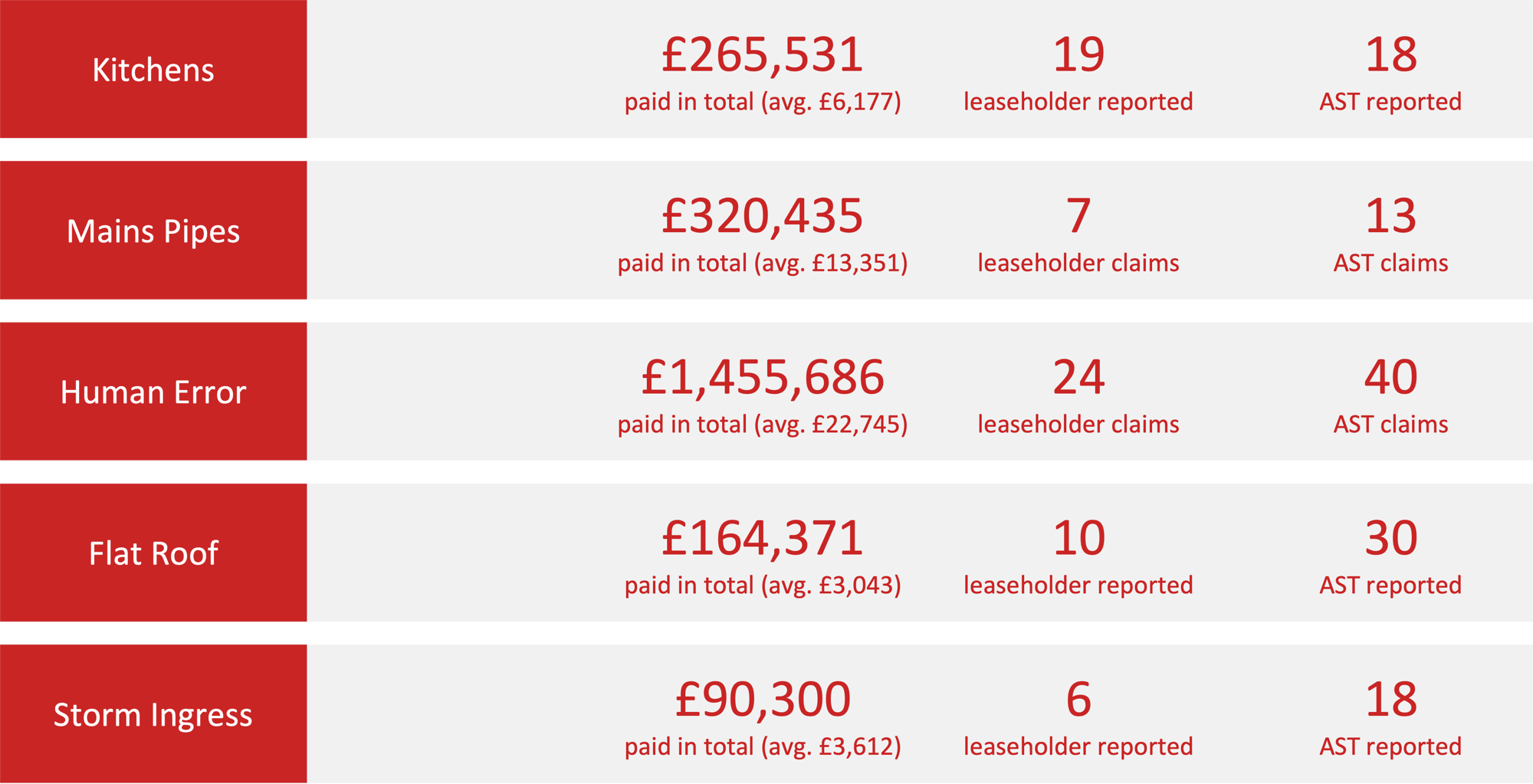

This is a more precise dive into where the money is being spent. Insurety analysed which claims had happened within leaseholder-occupied units and self-contained units (where a tenant occupies the property but has a leaseholder landlord).

Bathrooms are one of the biggest areas for claims. The vast majority of the claims are coming from tenant-occupied units.

Guttering and flat roof areas are usually reported by tenants, as found in this research.

Human error is responsible for the largest total amounts paid. Examples include leaving a tap or bath running, ignoring a leak from the back of the toilet that resulted in a larger claim than if it had been dealt with immediately, and cross-threading washing machines. The degradation of sealant can be a big issue and difficult to identify, as well as poor installation of washing machines.

Discover more about water escape in blocks from the experts by watching our webinar.

What is the excess?

Escape of water excess specifically refers to the higher excess amount policyholders must pay when filing a claim for water damage caused by internal sources. This higher excess reflects the frequent nature of such claims and their potentially high repair costs.

The excess is designed to protect the insurers. They use it as the main clue as to the history of the property because if there is a large excess, there have been claims in the past. The insurer would then look at the frequency of claims as well as the total cost of them. This will often spell out the issue that a bigger water claim is waiting to happen.

What is a two-tier excess?

If a leaseholder is not compliant or working collaboratively with the block manager, two-tier excess could set them straight. This will distinguish between the compliant leaseholder and the non-compliant leaseholder, which can be the difference between someone who is forthcoming about issues and someone who doesn't address the problems in their property that blatantly affect others.

An excess can be applied, such as £500 for compliance or £5,000 for non-compliance. Leases do not stipulate how the excesses are applied, which makes this possible.

How to keep these costs down

Access and inspections are the best way to keep on top of these issues. When accessing the leaseholder's domain for an inspection, the property manager must identify any problems as soon as they arise. That way, they can contact a plumber or contractor and save themselves a hefty claim.

Property managers can contact specialist firms who carry out building assessments to carry out a series of inspections. The firm will do these inspections, checking the kitchen, bathroom, boiler, heaters, and more for a full assessment. That way, they can identify any high-risk areas and pull together a report. The report is then sent to the leaseholders with areas they must address. A separate management report gets sent to the block, which identifies all the same areas.

Final thoughts

The frequency and severity of water escape incidents significantly influence the rising cost of buildings insurance. By understanding the definition of water escape, implementing swift and effective action when it occurs, and prioritising preventative maintenance, regular inspections, comprehensive insurance coverage, and meticulous documentation, block managers can play a crucial role in protecting their properties.

A proactive and informed approach to mitigating water escape is not just about reducing insurance premiums; it is about preserving the integrity of the building, ensuring the well-being of its occupants, and fostering a more resilient and sustainable property management strategy.

Be the first to hear about new content for Property Managers.

eBooks and webinars, always free

- Data-driven industry insights

- Compliance and legal updates

- Property management best practices